CBRE Global Investors Launches Exemplar UK ESG Programme

10 October 2019CBRE Global Investors Launches Exemplar UK ESG Programme

10 October 2019CBRE Global Investors has rolled out a new modular framework for managing environmental, social and governance (ESG) issues across its investment portfolio in the UK. Developed in consultation with institutional investors, fund managers and asset managers, the ESG programme sets out a three-year plan to drive progress on key issues identified through an extensive materiality review. Its innovative framework provides structure whilst being adaptable to the ambitions of different investors and to different types of funds and assets, as well as to changes in portfolios, markets, regulations and external standards.

Key Facts

- Structured, flexible ESG Programme rolled out across 30 funds

- Buy-in from institutional investors and fund, asset and property managers

- Driving progress on key ESG pillars of carbon, transparency and compliance

Situation

CBRE Global Investors (CBRE GI) is one of the world’s leading real asset investment managers, giving institutional clients access to real estate and infrastructure in the Americas, Europe and Asia Pacific.

CBRE GI and its parent company, CBRE, have a long track record for managing and reporting on environmental, social and governance (ESG) issues. They support the ten Principles of the United Nations (UN) Global Compact, the six Principles for Responsible Investment (PRI) and the 17 UN Sustainable Development Goals.

Many of CBRE GI’s institutional investors also have their own sustainability aspirations and commitments, and there is a range of ESG compliance requirements affecting different assets. In the UK, CBRE GI manages over 45 portfolios with £12bn AUM.

In this context, with the aid of the CBRE Sustainability Consultancy (CBRE SC), CBRE GI set about developing an ESG programme that would drive progress towards shared commitments across all funds, whilst offering flexibility for individual portfolios.

Drivers included recognition that:

- Responsible real estate investment management is essential to the delivery of world-class investment results and exceptional service for clients.

- Commercial real estate is at the nexus of many of today’s most important issues, including climate change, resource depletion and workplace health.

Actions

Stage 1: Analysis

CBRE SC carried out analysis of the ESG commitments and policies of each institutional investor, including:

- Environmental: carbon emissions, pollution, energy, water, transport, waste, materials, biodiversity and building certification.

- Social: community, charity & volunteering, health & safety, wellbeing and stakeholder engagement.

- Governance: board structure, human rights, compliance, procurement, transparency, employee rights and consumer rights.

They also reviewed the commitments, policies and strategies of CBRE Group and CBRE GI, and external standards such as the UN Global Compact, the UN Sustainable Development Goals (SDGs), the Carbon Disclosure Project[A1] (CDP), the Principles for Responsible Investment (PRI), the Task Force on Climate-related Financial Disclosures (TCFD), and the Global Real Estate Sustainability Benchmark (GRESB)[A2] , as well as building certifications such as BREEAM, LEED, Ska and WELL.

Stage 2: Workshops, Investor Survey and Materiality Matrix

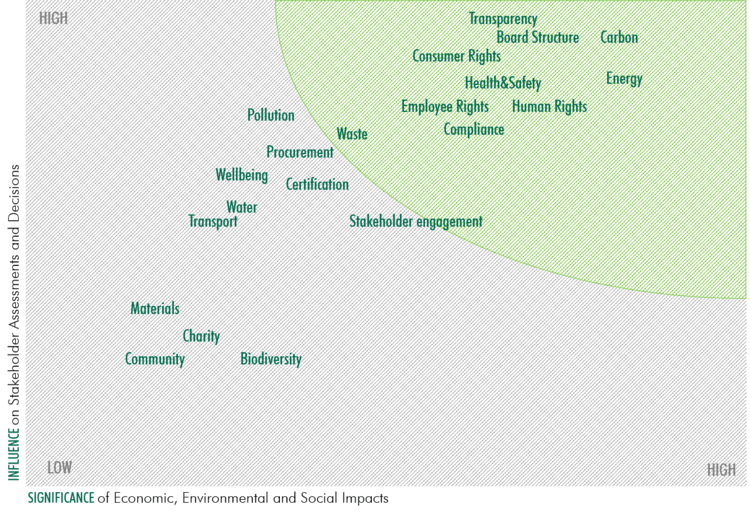

CBRE SC then held ESG workshops for each fund, looking at material issues and the level of ambition. Each workshop was attended by the ESG team, fund manager and asset managers. A materiality survey was also sent to all institutional investors, exploring what issues were most significant to them. Findings from the analysis, workshops and investor survey were then used to create an aggregated materiality matrix.

Stage 3: Planning

The materiality matrix exercise revealed three key ESG issues common across all portfolios. Thus, the ESG strategy was developed around these key pillars of carbon, transparency and compliance.

CBRE GI established three levels of implementation, depending on the level of ambition: Bronze, Silver and Gold. This categorisation is applicable to various aspects on asset and fund level, such as green leases and carbon emissions reduction targets. For each portfolio, the ESG team established three-year plans, targets and key performance indicators (KPIs), along with recommended actions at an asset level. They then held additional ESG workshops and calls with fund managers and clients to review these plans. Most have now been agreed.

Stage 4: Implementation

CBRE GI tendered for a partner to support the implementation of the ESG Programme, selecting CBRE’s Sustainability Consultancy out of six consultancies, thanks to their exceptional approach to tenant engagement on asset and corporate level. They are using Measurabl sustainability data software to record, benchmark and report all the KPI data. Progress on the three-year plan is fully reviewed annually.

At a corporate level, CBRE GI’s ESG team supervises the overall ESG programme. At a fund level, CBRE GI’s fund managers and asset managers are responsible for delivery. At an asset level, actions are undertaken by CBRE SC and property managers CBRE and Workman.

Different team members and partners are involved at an asset level, depending on the targets and actions. For instance, external consultants are brought in for energy audits; property managers are responsible for implementing asset improvement plans; property managers and CBRE SC lead on occupier engagement; and all are involved in GRESB and client reporting.

Benefits

- Supporting their ESG commitments and policies of CBRE GI and institutional investors, helping address many of today’s most important global issues, including climate change, whilst providing flexibility for diverse investors.

- Contributing to world-class investment results. Firms with good performance on material sustainability issues significantly outperform firms with poor performance, suggesting that ESG investment is value enhancing. In addition, firms with good performance on material issues and concurrently poor performance on immaterial issues perform the best, reflecting the importance of focusing on the most material issues.[i]

- Aligning with external standards such as UN Global Compact SDG, PRI, TCFD, REEB, GRESB and building certifications such as BREEAM and LEED.

[i] Khan et al: Corporate sustainability: first evidence on materiality, Harvard Business School working paper (2015).

Challenges and Achievements

COMPLEXITY

How to develop an ESG programme that works across diverse funds?

Initially, some fund managers and asset managers believed that, given the diverse drivers and client commitments across different funds, it would not be possible to develop a functional, unified ESG programme. However, as the materiality review progressed, common drivers and shared commitments emerged. Identifying the core pillars of carbon, transparency and compliance was an iterative process. The analysis, consultation and planning stages took slightly longer than anticipated, lasting around 12 months, but resulted in a robust, flexible approach that has buy-in across the board. The ESG programme framework provides structure whilst being adaptable to different investors and funds, as well as to changes in portfolios, markets and regulation. Rolling out the programme across 30 funds is also significantly more efficient than developing tailored strategies for each fund, which would otherwise have taken years.

ENGAGEMENT

How to gain buy-in from all parties?

The initial workshops were key to securing buy-in from fund managers and asset managers. At each workshop, the ESG team went through the fundamentals of ESG, exploring why issues such as carbon, resource use, wellbeing and transparency are important, and their relevance for the individual fund. They then looked at the commitments and policies of the client for that fund and of parent company CBRE, as well as external standards, such as the UN Sustainable Development Goals, CDP and PRI. This was followed by discussion around strategies in response to those commitments, policies and standards at a fund level, and what that might mean at an asset level. Fund managers also consulted with institutional investors, and the ESG team sent surveys to all institutional investors, receiving 37 responses that provided valuable input for the aggregated materiality matrix. At an asset level, the ESG team and asset managers engaged with property managers to bring them on board. During the implementation stage, property managers are supported by CBRE’s Energy and Sustainability practice. Benchmark reports produced through Measurabl enable comparison of performance by different funds and individual assets, introducing peer pressure, which drives further improvement.

*Please note that the information on this page was supplied by the BBP Member and the BBP assumes no responsibility or liability for any errors or omissions in the content